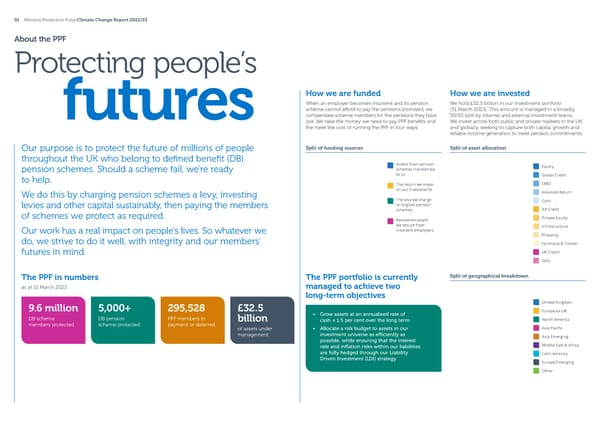

01 Pension Protection Fund Climate Change Report 2022/23 About the PPF Protecting people’s How we are funded How we are invested When an employer becomes insolvent and its pension We hold £32.5 billion in our investment portfolio scheme cannot a昀昀ord to pay the pensions promised, we (31 March 2023). This amount is managed in a broadly futures compensate scheme members for the pensions they have 50/50 split by internal and external investment teams. lost. We raise the money we need to pay PPF bene昀椀ts and We invest across both public and private markets in the UK the meet the cost of running the PPF in four ways: and globally, seeking to capture both capital growth and reliable income generation to meet pension commitments. Our purpose is to protect the future of millions of people Split of funding sources Split of asset allocation throughout the UK who belong to de昀椀ned bene昀椀t (DB) Assets from pension Equity pension schemes. Should a scheme fail, we’re ready schemes transferred to help. to us Global Credit The return we make EMD We do this by charging pension schemes a levy, investing on our investments Absolute Return The levy we charge Cash levies and other capital sustainably, then paying the members on eligible pension schemes Alt Credit of schemes we protect as required. Recovered assets Private Equity we secure from Infrastructure Our work has a real impact on people’s lives. So whatever we insolvent employers do, we strive to do it well, with integrity and our members’ Property Farmland & Timber futures in mind. UK Credit Gilts The PPF in numbers The PPF portfolio is currently Split of geographical breakdown as at 31 March 2023 managed to achieve two long-term objectives 9.6 million 5,000+ 295,528 £32.5 United Kingdom • Grow assets at an annualised rate of Europe ex UK DB scheme DB pension PPF members in billion cash + 1.5 per cent over the long term North America members protected scheme protected payment or deferred of assets under • Allocate a risk budget to assets in our Asia Pacific management investment universe as e昀케ciently as Asia Emerging possible, while ensuring that the interest rate and in昀氀ation risks within our liabilities Middle East & Africa are fully hedged through our Liability Latin America Driven Investment (LDI) strategy Europe Emerging Other

2022/23 | Climate Change Report Page 1 Page 3

2022/23 | Climate Change Report Page 1 Page 3