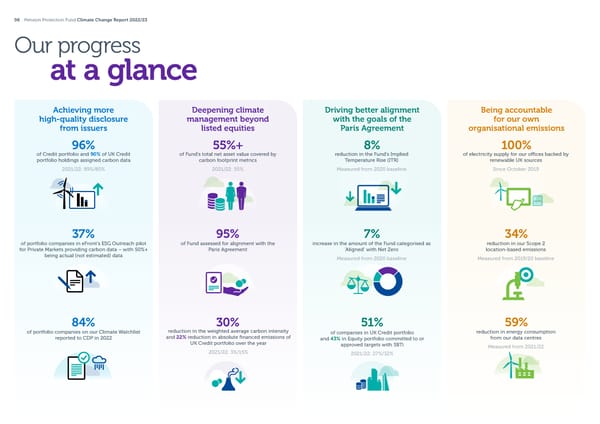

06 Pension Protection Fund Climate Change Report 2022/23 Our progress at a glance Achieving more Deepening climate Driving better alignment Being accountable high-quality disclosure management beyond with the goals of the for our own from issuers listed equities Paris Agreement organisational emissions 96% 55%+ 8% 100% of Credit portfolio and 90% of UK Credit of Fund’s total net asset value covered by reduction in the Fund’s Implied of electricity supply for our o昀케ces backed by portfolio holdings assigned carbon data carbon footprint metrics Temperature Rise (ITR) renewable UK sources 2021/22: 89%/80% 2021/22: 55% Measured from 2020 baseline Since October 2019 37% 95% 7% 34% of portfolio companies in eFront’s ESG Outreach pilot of Fund assessed for alignment with the increase in the amount of the Fund categorised as reduction in our Scope 2 for Private Markets providing carbon data – with 50%+ Paris Agreement ‘Aligned’ with Net Zero location-based emissions being actual (not estimated) data Measured from 2020 baseline Measured from 2019/20 baseline 84% 30% 51% 59% of portfolio companies on our Climate Watchlist reduction in the weighted average carbon intensity of companies in UK Credit portfolio reduction in energy consumption reported to CDP in 2022 and 22% reduction in absolute 昀椀nanced emissions of and 43% in Equity portfolio committed to or from our data centres UK Credit portfolio over the year approved targets with SBTi Measured from 2021/22 2021/22: 3%/15% 2021/22: 27%/32%

2022/23 | Climate Change Report Page 6 Page 8

2022/23 | Climate Change Report Page 6 Page 8