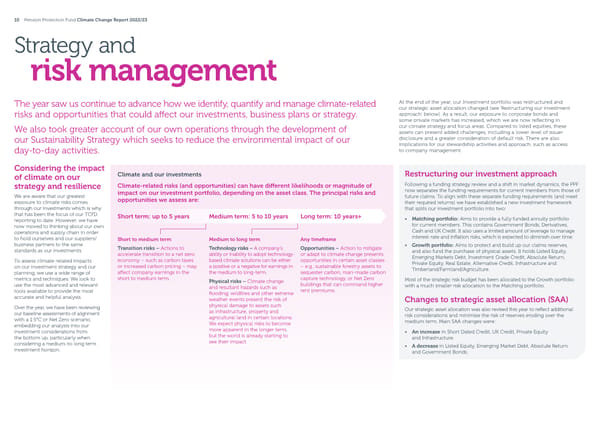

10 Pension Protection Fund Climate Change Report 2022/23 Strategy and risk management The year saw us continue to advance how we identify, quantify and manage climate-related At the end of the year, our Investment portfolio was restructured and our strategic asset allocation changed (see ‘Restructuring our investment risks and opportunities that could a昀昀ect our investments, business plans or strategy. approach’ below). As a result, our exposure to corporate bonds and some private markets has increased, which we are now re昀氀ecting in We also took greater account of our own operations through the development of our climate strategy and focus areas. Compared to listed equities, these assets can present added challenges, including a lower level of issuer our Sustainability Strategy which seeks to reduce the environmental impact of our disclosure and a greater consideration of default risk. There are also implications for our stewardship activities and approach, such as access day-to-day activities. to company management. Considering the impact of climate on our Climate and our investments Restructuring our investment approach strategy and resilience Climate-related risks (and opportunities) can have di昀昀erent likelihoods or magnitude of Following a funding strategy review and a shift in market dynamics, the PPF impact on our investment portfolio, depending on the asset class. The principal risks and now separates the funding requirements for current members from those of We are aware that our greatest opportunities we assess are: future claims. To align with these separate funding requirements (and meet exposure to climate risks comes their required returns) we have established a new investment framework through our investments which is why that splits our investment portfolio into two: that has been the focus of our TCFD Short term: up to 5 years Medium term: 5 to 10 years Long term: 10 years+ reporting to date. However, we have • Matching portfolio: Aims to provide a fully funded annuity portfolio now moved to thinking about our own for current members. This contains Government Bonds, Derivatives, operations and supply chain in order Cash and UK Credit. It also uses a limited amount of leverage to manage to hold ourselves and our suppliers/ Short to medium term Medium to long term Any timeframe interest-rate and in昀氀ation risks, which is expected to diminish over time. business partners to the same Transition risks – Actions to Technology risks – A company’s Opportunities – Action to mitigate • Growth portfolio: Aims to protect and build up our claims reserves, standards as our investments. accelerate transition to a net zero ability or inability to adopt technology- or adapt to climate change presents and also fund the purchase of physical assets. It holds Listed Equity, To assess climate-related impacts economy – such as carbon taxes based climate solutions can be either opportunities in certain asset classes Emerging Markets Debt, Investment Grade Credit, Absolute Return, on our investment strategy and our or increased carbon pricing – may a positive or a negative for earnings in –e.g., sustainable forestry assets to Private Equity, Real Estate, Alternative Credit, Infrastructure and planning, we use a wide range of a昀昀ect company earnings in the the medium to long-term. sequester carbon, man-made carbon Timberland/Farmland/Agriculture. metrics and techniques. We look to short to medium term. Physical risks – Climate change capture technology, or Net Zero Most of the strategic risk budget has been allocated to the Growth portfolio use the most advanced and relevant and resultant hazards such as buildings that can command higher with a much smaller risk allocation to the Matching portfolio. tools available to provide the most 昀氀ooding, wild昀椀res and other extreme rent premiums. accurate and helpful analysis. weather events present the risk of Changes to strategic asset allocation (SAA) Over the year, we have been reviewing physical damage to assets such Our strategic asset allocation was also revised this year to re昀氀ect additional our baseline assessments of alignment as infrastructure, property and risk considerations and minimise the risk of reserves eroding over the with a 1.5°C or Net Zero scenario, agricultural land in certain locations. medium term. Main SAA changes were: embedding our analysis into our We expect physical risks to become investment considerations from more apparent in the longer term, • An increase in Short Dated Credit, UK Credit, Private Equity the bottom up, particularly when but the world is already starting to and Infrastructure. considering a medium-to-long term see their impact. • A decrease in Listed Equity, Emerging Market Debt, Absolute Return investment horizon. and Government Bonds.

2022/23 | Climate Change Report Page 10 Page 12

2022/23 | Climate Change Report Page 10 Page 12