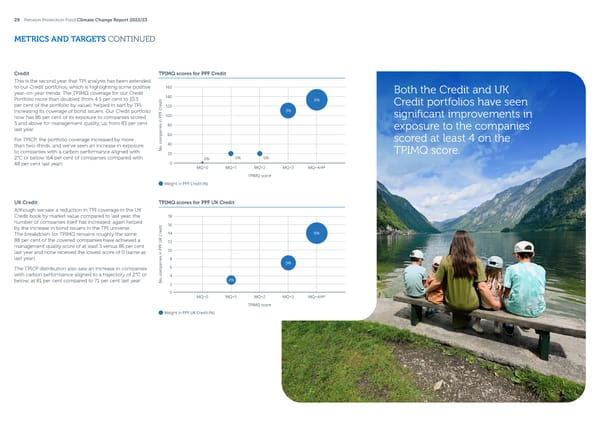

29 Pension Protection Fund Climate Change Report 2022/23 METRICS AND TARGETS CONTINUED Credit TPIMQ scores for PPF Credit This is the second year that TPI analysis has been extended to our Credit portfolios, which is highlighting some positive 160 Both the Credit and UK year-on-year trends. The TPIMQ coverage for our Credit 140 Portfolio more than doubled (from 4.5 per cent to 10.3 t 6% i d Credit portfolios have seen per cent of the portfolio by value), helped in part by TPI e 120 r C increasing its coverage of bond issuers. Our Credit portfolio 3% F 100 signi昀椀cant improvements in now has 86 per cent of its exposure to companies scored PP n i 3 and above for management quality, up from 83 per cent s 80 e last year. i exposure to the companies’ n a p 60 For TPICP, the portfolio coverage increased by more m scored at least 4 on the o c 40 than two-thirds, and we’ve seen an increase in exposure . o to companies with a carbon performance aligned with N 20 TPIMQ score. 2°C or below (64 per cent of companies compared with 0% 0% 0% 48 per cent last year). 0 MQ=0 MQ=1 MQ=2 MQ=3 MQ=4/4* TPIMQ score Weight in PPF Credit (%) UK Credit TPIMQ scores for PPF UK Credit Although we saw a reduction in TPI coverage in the UK Credit book by market value compared to last year, the 18 number of companies itself has increased, again helped t 16 by the increase in bond issuers in the TPI universe. i d e The breakdown for TPIMQ remains roughly the same: r 14 9% C 88 per cent of the covered companies have achieved a K U 12 management quality score of at least 3 versus 86 per cent F PP 10 last year and none received the lowest score of 0 (same as n i s last year). e 8 i n 5% a The TPICP distribution also saw an increase in companies p 6 m o with carbon performance aligned to a trajectory of 2°C or c 4 . below, at 81 per cent compared to 71 per cent last year. o 2% N 2 0 MQ=0 MQ=1 MQ=2 MQ=3 MQ=4/4* TPIMQ score Weight in PPF UK Credit (%)

2022/23 | Climate Change Report Page 29 Page 31

2022/23 | Climate Change Report Page 29 Page 31