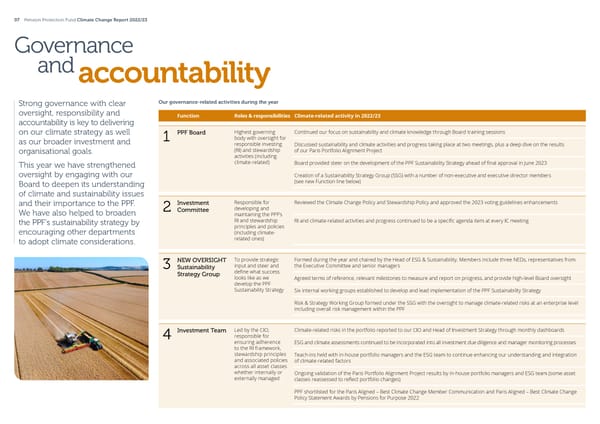

07 Pension Protection Fund Climate Change Report 2022/23 Governance andaccountability Strong governance with clear Our governance-related activities during the year oversight, responsibility and Function Roles & responsibilities Climate-related activity in 2022/23 accountability is key to delivering on our climate strategy as well PPF Board Highest governing Continued our focus on sustainability and climate knowledge through Board training sessions as our broader investment and 1 body with oversight for responsible investing Discussed sustainability and climate activities and progress taking place at two meetings, plus a deep dive on the results (RI) and stewardship organisational goals. of our Paris Portfolio Alignment Project activities (including climate-related) This year we have strengthened Board provided steer on the development of the PPF Sustainability Strategy ahead of 昀椀nal approval in June 2023 oversight by engaging with our Creation of a Sustainability Strategy Group (SSG) with a number of non-executive and executive director members Board to deepen its understanding (see new Function line below) of climate and sustainability issues and their importance to the PPF. Investment Responsible for Reviewed the Climate Change Policy and Stewardship Policy and approved the 2023 voting guidelines enhancements We have also helped to broaden 2 Committee developing and maintaining the PPF’s RI and stewardship the PPF’s sustainability strategy by RI and climate-related activities and progress continued to be a speci昀椀c agenda item at every IC meeting principles and policies encouraging other departments (including climate- to adopt climate considerations. related ones) NEW OVERSIGHT To provide strategic Formed during the year and chaired by the Head of ESG & Sustainability. Members include three NEDs, representatives from 3 Sustainability input and steer and the Executive Committee and senior managers Strategy Group de昀椀ne what success looks like as we Agreed terms of reference, relevant milestones to measure and report on progress, and provide high-level Board oversight develop the PPF Sustainability Strategy Six internal working groups established to develop and lead implementation of the PPF Sustainability Strategy Risk & Strategy Working Group formed under the SSG with the oversight to manage climate-related risks at an enterprise level including overall risk management within the PPF Investment Team Led by the CIO, Climate-related risks in the portfolio reported to our CIO and Head of Investment Strategy through monthly dashboards 4 responsible for ensuring adherence ESG and climate assessments continued to be incorporated into all investment due diligence and manager monitoring processes to the RI framework, stewardship principles Teach-ins held with in-house portfolio managers and the ESG team to continue enhancing our understanding and integration and associated policies of climate-related factors across all asset classes whether internally or Ongoing validation of the Paris Portfolio Alignment Project results by in-house portfolio managers and ESG team (some asset externally managed classes reassessed to re昀氀ect portfolio changes) PPF shortlisted for the Paris Aligned – Best Climate Change Member Communication and Paris Aligned – Best Climate Change Policy Statement Awards by Pensions for Purpose 2022

2022/23 | Climate Change Report Page 7 Page 9

2022/23 | Climate Change Report Page 7 Page 9