2022/23 | Climate Change Report

Our purpose is to protect the future of millions of people throughout the UK who belong to defined benefit (DB) pensionschemes. Should a scheme fail, we’re ready to help

2022/23 Climate Change Report Best UK Pension Fund (joint winner) – IPE Awards, December 2022

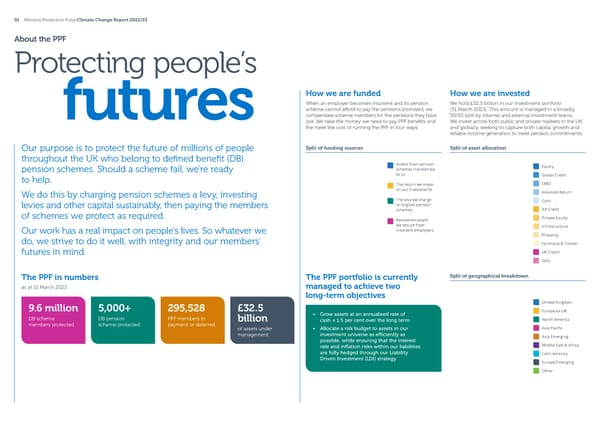

01 Pension Protection Fund Climate Change Report 2022/23 About the PPF Protecting people’s How we are funded How we are invested When an employer becomes insolvent and its pension We hold £32.5 billion in our investment portfolio scheme cannot a昀昀ord to pay the pensions promised, we (31 March 2023). This amount is managed in a broadly futures compensate scheme members for the pensions they have 50/50 split by internal and external investment teams. lost. We raise the money we need to pay PPF bene昀椀ts and We invest across both public and private markets in the UK the meet the cost of running the PPF in four ways: and globally, seeking to capture both capital growth and reliable income generation to meet pension commitments. Our purpose is to protect the future of millions of people Split of funding sources Split of asset allocation throughout the UK who belong to de昀椀ned bene昀椀t (DB) Assets from pension Equity pension schemes. Should a scheme fail, we’re ready schemes transferred to help. to us Global Credit The return we make EMD We do this by charging pension schemes a levy, investing on our investments Absolute Return The levy we charge Cash levies and other capital sustainably, then paying the members on eligible pension schemes Alt Credit of schemes we protect as required. Recovered assets Private Equity we secure from Infrastructure Our work has a real impact on people’s lives. So whatever we insolvent employers do, we strive to do it well, with integrity and our members’ Property Farmland & Timber futures in mind. UK Credit Gilts The PPF in numbers The PPF portfolio is currently Split of geographical breakdown as at 31 March 2023 managed to achieve two long-term objectives 9.6 million 5,000+ 295,528 £32.5 United Kingdom • Grow assets at an annualised rate of Europe ex UK DB scheme DB pension PPF members in billion cash + 1.5 per cent over the long term North America members protected scheme protected payment or deferred of assets under • Allocate a risk budget to assets in our Asia Pacific management investment universe as e昀케ciently as Asia Emerging possible, while ensuring that the interest rate and in昀氀ation risks within our liabilities Middle East & Africa are fully hedged through our Liability Latin America Driven Investment (LDI) strategy Europe Emerging Other

0202 PPeennssiioon Pn Prrototeeccttiioon Fn Fuunndd C Clliimmaatte Ce Chhaanngge Re Reeppoorrt 2t 2020222//2233 Contents 03 Introduction from our Chair 04 Key achievements 05 O verview: Make every investment transparent and accountable 06 Our progress at a glance 07 Governance and accountability 10 Strategy and risk management 19 Metrics and progress 36 Setting aspirational targets 37 Appendices

03 Pension Protection Fund Climate Change Report 2022/23 Introduction from our Chair Our work at the PPF has a We have always been guided by the principle • Demonstrating excellence in responsible investment that investing responsibly is critical to ensuring • Ensuring e昀昀ective stakeholder engagement with real impact on people’s sustainable returns for our stakeholders. For this integrity and respect reason, responsible investment has remained central lives. We believe embedding to how we manage our investment portfolio. We also • Championing collaboration and leading by example believe that placing sustainability at the heart of our • Being accountable for minimising our own sustainability in all of our activities is key to mitigating some of the material environmental impacts. ESG risks we face as an organisation. We have set ourselves high standards on climate activities and decisions will One of the four priorities of our Strategic Plan is change and responsible investment. Our target is to ‘Making a di昀昀erence’. As a public body, we’re in reach Net Zero for our operations by 2035 or sooner. bene昀椀t our members, levy a unique position. We want to share what we’re For our investments, we seek to contribute to the learning with others, and we want to catalyse the global transition to Net Zero through our portfolio payers, employees and our growth of a more sustainable pensions industry. and engagement activities. Our ambition is to make a di昀昀erence using our local communities alike. in昀氀uence in the pensions industry and in our The integrity of our commitments matters a great local communities. deal to us. Our sustainability goals will be re昀氀ected We were very proud to be named Best UK Pension Fund as a in every part of life at the PPF, from investment joint winner at the IPE Awards in December 2022. The judges As part of this, we have developed a holistic decisions and engaging with our stakeholders, highlighted the PPF’s ‘steady performance, with Environmental, sustainability strategy that builds on our established through to recruitment and the selection of Social and Governance at the heart of our investment strategy’. responsible investment strategy, our Diversity and our suppliers. We are proud to share our update This win recognises our e昀昀orts to be a leading responsible Inclusion strategy, and our Community Impact for this year. investor and the progress we have made to improve access to plan. We’ve drawn upon our organisational values, Kate Jones ESG-related data, advance ESG practices among our external the Five Capitals framework for sustainability, and Chair managers and support opportunities to deploy capital for an assessment of our material ESG risks, to identify positive social and environmental impact. four key sustainability goals: Pension Protection Fund

04 Pension Protection Fund Climate Change Report 2022/23 Key achievements Addressing the risks and opportunities arising from climate change is key to our responsible investment and organisational goals. Utilising a sustainability lens has enhanced our decision-making by providing us with an alternative way of considering risks and bene昀椀ts that we may face, whether in relation to our investment portfolio or within our own operations. Governance Created a new steering group Provided ongoing training and Enhanced our voting guidelines with Maintained our signatory status under Created clear commitment and accountability to govern and oversee our new education to upskill our Board, additional expectations for companies’ the FRC’s UK Stewardship Code 2020 to and oversight of action to Sustainability Strategy Executive Committee and climate strategy and management reduce climate-related risks Investment team on behalf of our members See page 07 See page 09 See page 09, Appendix F Strategy and Introduced our new Sustainability Demonstrated continued progress Created a new Climate Watchlist to CIO Asset Owner Industry Innovation Acted to manage exposure risk management Strategy – two key goals are focused on our Paris Portfolio Alignment address the companies contributing Awards 2022: Winner for E昀昀orts in to climate risks across our on integrating climate-related risks assessments, increasing our Fund’s to over 70 per cent of our material ESG and IPE Best UK Pension Fund; portfolios and our business into the strategy (our investments exposure to Aligned assets and 昀椀nanced emissions Joint Winners to safeguard our members’ and our operations) reducing the allocation to Not Aligned future 昀椀nancial wellbeing See page 11 See page 13 See page 16 Engagement Began embedding our sustainability Collaborated with our external Developing targeted engagement Successfully engaged with a number Continued to support and and collaboration considerations across the organisation, consultant to enhance our Real Estate action plans for each company on of our holdings to encourage CDP encourage industry best led by our six sustainability portfolio’s alignment methodology the Climate Watchlist disclosure, as part of the CDP practice to protect the working groups Non-Disclosure Campaign long-term interests of our members See page 11 See page 32 See page 16 See page 17 Disclosure Further evolved sustainability reporting Obtained valuable ESG and climate Expanded our 昀椀nanced emissions Paris Alignment Awards 2022: Shared as deep an insight as on our operational impacts, including disclosures from our Private Markets reporting to include Scope 3 emissions Shortlisted for Best Climate Change possible into our exposure Scope 2 market-based emissions managers participating in the eFront and EM sovereign emissions Member Communication and Best to climate change within our to re昀氀ect 100 per cent renewable ESG Outreach pilot project Climate Change Policy Statement investments and our operations electricity use to provide transparency for our stakeholders See page 35 and our 2022/23 See page 18 See pages 23–24 Annual Report & Accounts

This is a modal window.

05 Pension Protection Fund Climate Change Report 2022/23 Overview: Make every investment transparent and accountable The past 18 months have been challenging for everyone in the industry, with the onset of the war in Ukraine, the LDI crisis in Autumn 2022 and persistent high in昀氀ation. Among all of this, ESG and climate change remains at the core of our approach and strategy. Putting sustainability into action I’ve always 昀椀rmly believed in understanding That’s also why we’re so supportive of Setting new standards in responsible investing, leading by example and our risks, and doing so using evidence-based innovations looking to streamline ESG sharing our learnings to help others are at the heart of the PPF’s values. data. In last year’s Climate Change report, reporting, such as eFront’s ESG Outreach We’ve seen signi昀椀cant progress in our fund managers’ ESG practices, we introduced the Paris Portfolio Alignment project where the pilot has already delivered as evidenced by the growth over the last few years in the number of our Project that we initiated in partnership with actual emissions data for a number of our external managers who have become PRI signatories (90 per cent in 2022). Dutch consultancy Ortec Finance. We’ve been portfolio companies. The sooner we can use spending considerable time gathering climate our day-to-day systems to access emissions Collaborating with partners and others in the industry is fundamental to assessments across every asset class in the data for our private markets holdings, the our responsible investment strategy and we will continue to help de昀椀ne Fund so we can see how the Fund’s position more con昀椀dence we can have in making best practice. aligns to Net Zero and the Paris Agreement, investment decisions informed by our and we’ve continually evolved this to re昀氀ect portfolio alignment positioning. We will continue to push ourselves to further the sustainability of our new methodologies and changes in our investments, as well as minimising our environmental impacts in order portfolios. This has been helping us improve In December 2022, I was honoured to to achieve our target of reaching Net Zero for our operations by 2035 our understanding of ESG data and make receive the CIO Asset Owner Industry or sooner. more informed decisions about the portfolio, Innovation Award for E昀昀orts in ESG. This especially in our unlisted investments where award recognises asset owners driving pre-investment due diligence is even more change within their allocation approaches Oliver Morley critical. We’re encouraged to see the progress and enhancing institutional fund performance. Chief Executive already made on the Fund’s alignment since I and the whole PPF investment team will 2020, as more companies have committed to continue to look to lead on best practice setting science-based targets and have started in understanding the climate risks of every to share their transition plans with investors. investment we hold both now and in the future. Gathering this additional data has been crucial to us. However, the sheer speed of change Barry Kenneth surrounding ESG continues to keep us on Chief Investment O昀케cer our toes and is one of the reasons I use a lot of data internally, through our portfolio management systems, so that we can directly monitor our portfolios on a real-time basis.

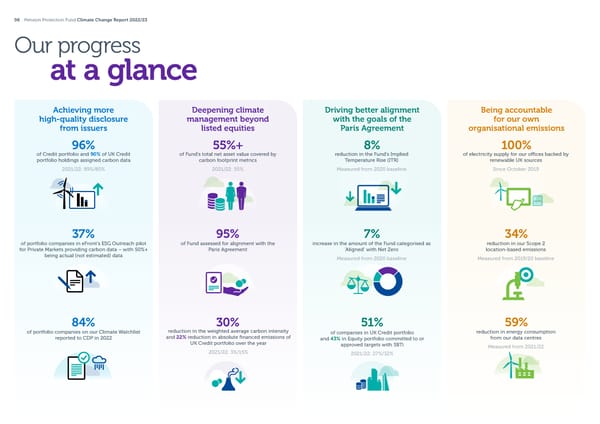

06 Pension Protection Fund Climate Change Report 2022/23 Our progress at a glance Achieving more Deepening climate Driving better alignment Being accountable high-quality disclosure management beyond with the goals of the for our own from issuers listed equities Paris Agreement organisational emissions 96% 55%+ 8% 100% of Credit portfolio and 90% of UK Credit of Fund’s total net asset value covered by reduction in the Fund’s Implied of electricity supply for our o昀케ces backed by portfolio holdings assigned carbon data carbon footprint metrics Temperature Rise (ITR) renewable UK sources 2021/22: 89%/80% 2021/22: 55% Measured from 2020 baseline Since October 2019 37% 95% 7% 34% of portfolio companies in eFront’s ESG Outreach pilot of Fund assessed for alignment with the increase in the amount of the Fund categorised as reduction in our Scope 2 for Private Markets providing carbon data – with 50%+ Paris Agreement ‘Aligned’ with Net Zero location-based emissions being actual (not estimated) data Measured from 2020 baseline Measured from 2019/20 baseline 84% 30% 51% 59% of portfolio companies on our Climate Watchlist reduction in the weighted average carbon intensity of companies in UK Credit portfolio reduction in energy consumption reported to CDP in 2022 and 22% reduction in absolute 昀椀nanced emissions of and 43% in Equity portfolio committed to or from our data centres UK Credit portfolio over the year approved targets with SBTi Measured from 2021/22 2021/22: 3%/15% 2021/22: 27%/32%

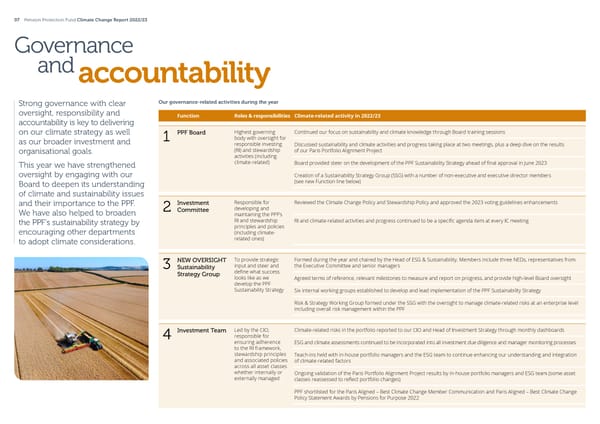

07 Pension Protection Fund Climate Change Report 2022/23 Governance andaccountability Strong governance with clear Our governance-related activities during the year oversight, responsibility and Function Roles & responsibilities Climate-related activity in 2022/23 accountability is key to delivering on our climate strategy as well PPF Board Highest governing Continued our focus on sustainability and climate knowledge through Board training sessions as our broader investment and 1 body with oversight for responsible investing Discussed sustainability and climate activities and progress taking place at two meetings, plus a deep dive on the results (RI) and stewardship organisational goals. of our Paris Portfolio Alignment Project activities (including climate-related) This year we have strengthened Board provided steer on the development of the PPF Sustainability Strategy ahead of 昀椀nal approval in June 2023 oversight by engaging with our Creation of a Sustainability Strategy Group (SSG) with a number of non-executive and executive director members Board to deepen its understanding (see new Function line below) of climate and sustainability issues and their importance to the PPF. Investment Responsible for Reviewed the Climate Change Policy and Stewardship Policy and approved the 2023 voting guidelines enhancements We have also helped to broaden 2 Committee developing and maintaining the PPF’s RI and stewardship the PPF’s sustainability strategy by RI and climate-related activities and progress continued to be a speci昀椀c agenda item at every IC meeting principles and policies encouraging other departments (including climate- to adopt climate considerations. related ones) NEW OVERSIGHT To provide strategic Formed during the year and chaired by the Head of ESG & Sustainability. Members include three NEDs, representatives from 3 Sustainability input and steer and the Executive Committee and senior managers Strategy Group de昀椀ne what success looks like as we Agreed terms of reference, relevant milestones to measure and report on progress, and provide high-level Board oversight develop the PPF Sustainability Strategy Six internal working groups established to develop and lead implementation of the PPF Sustainability Strategy Risk & Strategy Working Group formed under the SSG with the oversight to manage climate-related risks at an enterprise level including overall risk management within the PPF Investment Team Led by the CIO, Climate-related risks in the portfolio reported to our CIO and Head of Investment Strategy through monthly dashboards 4 responsible for ensuring adherence ESG and climate assessments continued to be incorporated into all investment due diligence and manager monitoring processes to the RI framework, stewardship principles Teach-ins held with in-house portfolio managers and the ESG team to continue enhancing our understanding and integration and associated policies of climate-related factors across all asset classes whether internally or Ongoing validation of the Paris Portfolio Alignment Project results by in-house portfolio managers and ESG team (some asset externally managed classes reassessed to re昀氀ect portfolio changes) PPF shortlisted for the Paris Aligned – Best Climate Change Member Communication and Paris Aligned – Best Climate Change Policy Statement Awards by Pensions for Purpose 2022

08 Pension Protection Fund Climate Change Report 2022/23 GOVERNANCE AND ACCOUNTABILITY CONTINUED Our governance-related activities during the year continued Function Roles & responsibilities Climate-related activity in 2022/23 EXPANDED REMIT Part of the Provided updates at the daily Investment Team meetings on ESG issues and trends throughout the year 5 ESG & Sustainability Investment Team, helping to oversee Team Remit expanded to include delivery of the PPF’s organisational Sustainability Strategy, and renamed the ESG & Sustainability Team implementation of the RI framework, monitor Stewardship Manager recruited to focus on the Stewardship strategy and activities, including Net Zero stewardship, and to build investments for ESG on existing oversight mechanisms risks and opportunities, engage with portfolio A Sustainability Analyst also hired this year to help develop and implement the new Sustainability Strategy managers, external managers and Updated our voting guidelines for the 2023 voting season, in particular setting higher expectations from companies on climate- our stewardship related issues (see Appendix F) services provider Finalised our Climate Watchlist of around 80 companies in our public markets portfolios that will receive more targeted engagement around climate transition Asset Managers Follows the PPF’s Asset Managers: 6 and Stewardship RI framework and Oversight of our external managers continued through their ESG and climate reporting to us (requested quarterly from our stewardship policy, Services Provider* liquid markets managers and annually from private markets managers) undertakes ESG * EOS at Federated integration and issuer Hermes (EOS). engagement then Encouraged a number of private markets managers to disclose core ESG and climate data through the new eFront ESG reports transparently Outreach pilot project and accordingly Where pooled funds are not included in the EOS service, we continued to hold quarterly manager meetings, requesting bespoke ESG reporting in advance Stewardship Services Provider: Last year’s action to consolidate several external managers onto the EOS voting and engagement platform has enabled increased oversight and continuity in our stewardship activities this year Engaged with EOS on policy updates and service provision, participated in group feedback sessions and meetings to ensure robust oversight The PPF retained the ability to review individual meetings and submit vote instructions on all voting platforms, amending individual votes where we see 昀椀t

This is a modal window.

09 Pension Protection Fund Climate Change Report 2022/23 GOVERNANCE AND ACCOUNTABILITY CONTINUED Climate and sustainability training • Climate Action 100+ Net Zero Benchmark constituents where companies have no medium-term targets in place Board ESG credentials Next steps A key governance aim this year was to build internal • Companies expanding coal-昀椀red infrastructure or that knowledge and understanding at the PPF of sustainability, have signi昀椀cant dependence on coal without a su昀케ciently The composition of the PPF Board has always Further training will include improving carbon and especially climate, issues through training and education. ambitious timeline and strategy for coal phase-out been crucial in stewarding value creation while literacy for PPF employees more widely, and a deep Two external speakers were invited to speak to the PPF • For deforestation, companies that score low on the also managing ESG risks. We have a Board member dive on o昀昀setting carbon emissions. Board about their experience and insights, followed by a Forest 500 rankings. with particular ESG expertise, who is also one of panel discussion and Q&A. One speaker gave an overview the members of our Sustainability Strategy Group. We will de昀椀ne more interim targets for the See Appendix F Sustainability Strategy and move into an from a non-昀椀nancial services perspective and the other for our full voting guidelines policy update. The PPF Board is proactive and regularly updated focused on how a listed asset manager is approaching by the ESG & Sustainability Team on the latest implementation phase. sustainability and its commitment to supporting Net Zero. In-house additional review process developments and thinking in ESG, sustainability For UK and other European companies, we now review and climate risk management. A Board strategy away-day included deep-dive interactive any shareholder proposals related to climate change workshops covering ESG materiality assessments, Net Zero internally. Shareholder meetings at companies on our target setting, and communicating sustainability issues to Climate Watchlist are also reviewed internally by the ESG & all stakeholders. Sustainability Team. Both steps will allow additional analysis Our approach to Responsible Investment (RI) and stewardship Upskilling of the Investment team on climate has continued around the progress being made against our internally-set throughout the year. The ESG team presented the results targets. A vote against management may be necessary if Our RI framework puts our core beliefs into practice: of the Paris Portfolio Alignment Project, including baseline we consider there has been inadequate progress on climate and subsequent progress. Executive Committee and Board strategy and management. members were also invited to attend. RI Framework Sustainability Strategy Enhancing voting guidelines accountability Strategic and oversight Governance & direction Risk Metrics & This year saw the publication of the PPF Sustainability accountability & policy management transparency In order to measurably track and encourage progress on Strategy, another critical development to help ensure the climate action, we use the Transition Pathway Initiative’s Fund’s longevity, enable us to lead by example and catalyse Management Quality assessment of companies (TPIMQ). the growth of a more sustainable pensions industry. Priorities We are also informed by the Climate Action 100+ Net Zero The Sustainability Strategy is a result of collaborative e昀昀orts, Company Benchmark and guided in our voting by industry starting at PPF Board level and cascading down to internal initiatives around Net Zero alignment for both asset owners Sustainability Working Groups. We have established a and our asset managers. clear line of leadership and accountability for developing, For 2023 voting decisions, we increased the TPIMQ delivering and evaluating the strategy. Climate Change Stewardship Reporting score thresholds for climate-related voting guidelines, This gives the PPF Board ultimate oversight with the authority particularly for: to approve and amend the strategy as deemed necessary. • European and Australian companies in speci昀椀c sectors As detailed in the panel on page 07, a Sustainability Strategy Climate & sustainability Engaging with (coal, oil, gas, utilities and autos) Group (SSG) has been created to steer development of the policies & strategies fund managers Internal ESG dashboards strategy and de昀椀ne what success looks like. Climate stewardship Engaging with issuers Investment Committee & Board reporting Climate risk assessments Voting of shares External RI reporting & sustainability reporting Climate Collaborative engagement External climate reporting opportunities & public policy

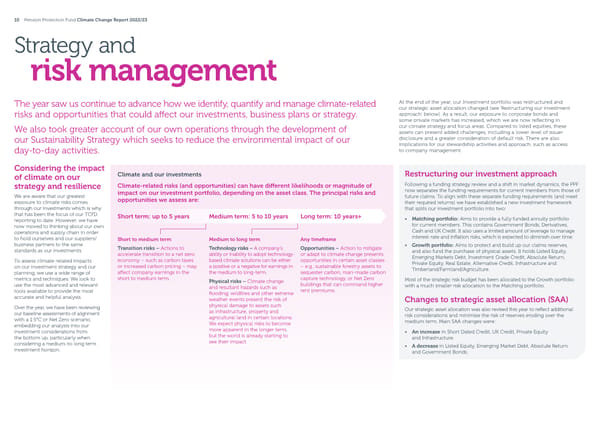

10 Pension Protection Fund Climate Change Report 2022/23 Strategy and risk management The year saw us continue to advance how we identify, quantify and manage climate-related At the end of the year, our Investment portfolio was restructured and our strategic asset allocation changed (see ‘Restructuring our investment risks and opportunities that could a昀昀ect our investments, business plans or strategy. approach’ below). As a result, our exposure to corporate bonds and some private markets has increased, which we are now re昀氀ecting in We also took greater account of our own operations through the development of our climate strategy and focus areas. Compared to listed equities, these assets can present added challenges, including a lower level of issuer our Sustainability Strategy which seeks to reduce the environmental impact of our disclosure and a greater consideration of default risk. There are also implications for our stewardship activities and approach, such as access day-to-day activities. to company management. Considering the impact of climate on our Climate and our investments Restructuring our investment approach strategy and resilience Climate-related risks (and opportunities) can have di昀昀erent likelihoods or magnitude of Following a funding strategy review and a shift in market dynamics, the PPF impact on our investment portfolio, depending on the asset class. The principal risks and now separates the funding requirements for current members from those of We are aware that our greatest opportunities we assess are: future claims. To align with these separate funding requirements (and meet exposure to climate risks comes their required returns) we have established a new investment framework through our investments which is why that splits our investment portfolio into two: that has been the focus of our TCFD Short term: up to 5 years Medium term: 5 to 10 years Long term: 10 years+ reporting to date. However, we have • Matching portfolio: Aims to provide a fully funded annuity portfolio now moved to thinking about our own for current members. This contains Government Bonds, Derivatives, operations and supply chain in order Cash and UK Credit. It also uses a limited amount of leverage to manage to hold ourselves and our suppliers/ Short to medium term Medium to long term Any timeframe interest-rate and in昀氀ation risks, which is expected to diminish over time. business partners to the same Transition risks – Actions to Technology risks – A company’s Opportunities – Action to mitigate • Growth portfolio: Aims to protect and build up our claims reserves, standards as our investments. accelerate transition to a net zero ability or inability to adopt technology- or adapt to climate change presents and also fund the purchase of physical assets. It holds Listed Equity, To assess climate-related impacts economy – such as carbon taxes based climate solutions can be either opportunities in certain asset classes Emerging Markets Debt, Investment Grade Credit, Absolute Return, on our investment strategy and our or increased carbon pricing – may a positive or a negative for earnings in –e.g., sustainable forestry assets to Private Equity, Real Estate, Alternative Credit, Infrastructure and planning, we use a wide range of a昀昀ect company earnings in the the medium to long-term. sequester carbon, man-made carbon Timberland/Farmland/Agriculture. metrics and techniques. We look to short to medium term. Physical risks – Climate change capture technology, or Net Zero Most of the strategic risk budget has been allocated to the Growth portfolio use the most advanced and relevant and resultant hazards such as buildings that can command higher with a much smaller risk allocation to the Matching portfolio. tools available to provide the most 昀氀ooding, wild昀椀res and other extreme rent premiums. accurate and helpful analysis. weather events present the risk of Changes to strategic asset allocation (SAA) Over the year, we have been reviewing physical damage to assets such Our strategic asset allocation was also revised this year to re昀氀ect additional our baseline assessments of alignment as infrastructure, property and risk considerations and minimise the risk of reserves eroding over the with a 1.5°C or Net Zero scenario, agricultural land in certain locations. medium term. Main SAA changes were: embedding our analysis into our We expect physical risks to become investment considerations from more apparent in the longer term, • An increase in Short Dated Credit, UK Credit, Private Equity the bottom up, particularly when but the world is already starting to and Infrastructure. considering a medium-to-long term see their impact. • A decrease in Listed Equity, Emerging Market Debt, Absolute Return investment horizon. and Government Bonds.

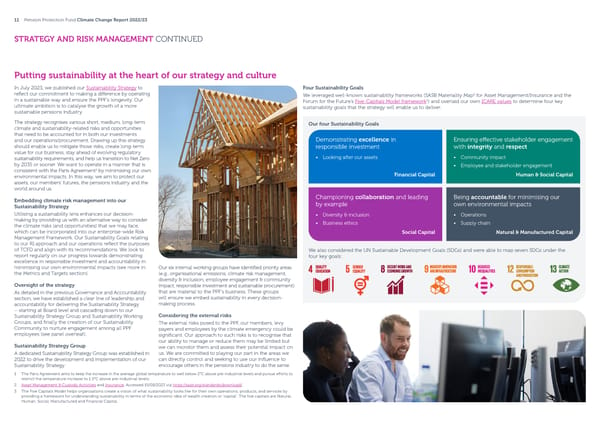

11 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED Putting sustainability at the heart of our strategy and culture In July 2023, we published our Sustainability Strategy to Four Sustainability Goals re昀氀ect our commitment to making a di昀昀erence by operating 2 We leveraged well-known sustainability frameworks (SASB Materiality Map for Asset Management/Insurance and the in a sustainable way and ensure the PPF’s longevity. Our 3 Forum for the Future’s Five-Capitals Model framework ) and overlaid our own ICARE values to determine four key ultimate ambition is to catalyse the growth of a more sustainability goals that the strategy will enable us to deliver. sustainable pensions industry. The strategy recognises various short, medium, long-term Our four Sustainability Goals climate and sustainability-related risks and opportunities that need to be accounted for in both our investments and our operations/procurement. Drawing up this strategy Demonstrating excellence in Ensuring e昀昀ective stakeholder engagement should enable us to mitigate those risks, create long-term responsible investment with integrity and respect value for our business, stay ahead of evolving regulatory sustainability requirements, and help us transition to Net Zero • Looking after our assets • Community impact by 2035 or sooner. We want to operate in a manner that is • Employee and stakeholder engagement 1 consistent with the Paris Agreement by minimising our own Financial Capital Human & Social Capital environmental impacts. In this way, we aim to protect our assets, our members’ futures, the pensions industry and the world around us. Embedding climate risk management into our Championing collaboration and leading Being accountable for minimising our Sustainability Strategy by example own environmental impacts Utilising a sustainability lens enhances our decision- • Diversity & inclusion • Operations making by providing us with an alternative way to consider • Business ethics • Supply chain the climate risks (and opportunities) that we may face, which can be incorporated into our enterprise-wide Risk Social Capital Natural & Manufactured Capital Management Framework. Our Sustainability Goals relating to our RI approach and our operations re昀氀ect the purposes of TCFD and align with its recommendations. We look to We also considered the UN Sustainable Development Goals (SDGs) and were able to map seven SDGs under the report regularly on our progress towards demonstrating four key goals: excellence in responsible investment and accountability in minimising our own environmental impacts (see more in Our six internal working groups have identi昀椀ed priority areas the Metrics and Targets section). (e.g., organisational emissions, climate risk management, diversity & inclusion, employee engagement & community Oversight of the strategy impact, responsible investment and sustainable procurement) As detailed in the previous Governance and Accountability that are material to the PPF’s business. These groups section, we have established a clear line of leadership and will ensure we embed sustainability in every decision- accountability for delivering the Sustainability Strategy making process. –starting at Board level and cascading down to our Sustainability Strategy Group and Sustainability Working Considering the external risks Groups, and 昀椀nally the creation of our Sustainability The external risks posed to the PPF, our members, levy Community to nurture engagement among all PPF payers and employees by the climate emergency could be employees (see panel overleaf). signi昀椀cant. Our approach to such risks is to recognise that our ability to manage or reduce them may be limited but Sustainability Strategy Group we can monitor them and assess their potential impact on A dedicated Sustainability Strategy Group was established in us. We are committed to playing our part in the areas we 2022 to drive the development and implementation of our can directly control and seeking to use our in昀氀uence to Sustainability Strategy. encourage others in the pensions industry to do the same. 1 The Paris Agreement aims to keep the increase in the average global temperature to well below 2°C above pre-industrial levels and pursue e昀昀orts to restrict the temperature increase to 1.5°C above pre-industrial levels. 2 Asset Management & Custody Activities and Insurance. Accessed 15/08/2023 via https://sasb.org/standards/download/. 3 The Five Capitals Model helps organisations create a vision of what sustainability looks like for their own operations, products, and services by providing a framework for understanding sustainability in terms of the economic idea of wealth creation or ‘capital’. The 昀椀ve capitals are Natural, Human, Social, Manufactured and Financial Capital.

12 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED Our Sustainability Community Next steps To support our Sustainability Goal ‘Ensuring e昀昀ective stakeholder engagement Employees are able to post their thoughts on various signi昀椀cant days – such with integrity and respect’, we established a Sustainability Community as World Environment Day and Earth Day – and receive/share tips on making We will develop a Climate Change networking hub on the PPF’s intranet this year. Open to all PPF employees, the a positive environmental impact (e.g., using reusable co昀昀ee cups, sharing Adaptation Plan, which will assess Hub aims to inspire and educate on the values and importance of sustainability experience of installing solar panels or buying an electric vehicle.) the potential impact of physical both in the PPF and the broader community. PPF employees are encouraged risks of climate change on our to share their ideas and suggestions to minimise their environmental impacts. operations and our resilience to these risks (long term as well as acute). We have started to carry out climate-change stress tests in our Long-Term Risk Model, which we use to model potential future scenarios for our liabilities, including stress-testing the impact on the PPF’s own balance sheet. Sustainability is about impact – on society, our communities and the environment. Together, we can make a real di昀昀erence to people’s lives.

13 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED CASE STUDY Progressing our Work continued throughout this year to refresh our assessments in the Equity, Credit and Real Estate asset Paris Portfolio Alignment Project classes that saw turnover or allocation changes. We can now track how our portfolio alignment has progressed across a number of time periods, and we have already seen Last year we reported on our innovative project to assess the implied good progress. For example, we have seen the percentage temperature rise (ITR) of our portfolio relative to the goals of the 2015 PPF Fund Paris Alignment of the Fund categorised as ‘Not Aligned’ decline by 11 per cent while the percentage classi昀椀ed as ‘Aligned’ increased Paris Agreement. Subsequent analysis has helped us become better +7% -11% by 7 per cent between December 2020 and 2022. informed about our position and how di昀昀erent parts of our portfolio The main driver for the declining allocation to ‘Not Aligned’ might be contributing to climate change. Dec-22 is down to the exponential success of the Science-Based Targets initiative (SBTi), which has nudged many companies up to the ‘Committed to Align’ bucket. In 2020, there were Initiated in early 2021, the Paris Portfolio Alignment ITR for PPF portfolio 2020–2022 918 companies signed up to the SBTi, of which 495 had Project aims to help us: Dec-21 approved targets. By May 2023, this had grown to 5,309 companies. See more in Metrics and Targets. • Understand where – if business were to continue 2.6 as usual – our investment portfolio stands from a 2.5 -8% Strengthening our decarbonisation approach bottom-up perspective in terms of alignment with the 2.4 Dec-20 The Paris Portfolio Alignment Project has enabled us to set Paris Agreement 2.3 a more con昀椀dent direction for decarbonising our portfolio • Develop methodologies for 昀椀lling gaps in asset classes than if we had only set a top-down target – for example – especially among private companies – and try-and- 2.2 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% feeding into the creation of our Climate Watchlist (see test the emerging methodologies 2.1 Net Zero Aligned page 16). It has also allowed us to contribute directly to 2.0 advancing the measurement and management of climate • Assess ITR contributions by all asset classes in order to Committed to Align/Aligning Not Aligned risk using a Paris alignment lens, and identi昀椀ed where identify speci昀椀c companies/assets that are misaligned 1.9 Insufficient data Not included we and our peers need to push for improvements in • Develop engagement strategies for the largest 1.8 alignment data and reporting. contributors to climate change to improve their 1.7 alignment, or consider escalation options, while still How we have categorised our alignment assessments: focusing on meeting our investment objectives. 1.6 Net Zero: Assets already achieving net zero emissions Next steps 1.5 Aligned: Assets with ITR score of 1.5°C or lower; Progress on the PPF ITR score Dec-20 Dec-21 Dec-22 assets with carbon performance aligned with their Each desk within our Investment team has We reported the high-level ITR 昀椀ndings of the 2020 sector Net Zero pathway designated areas of focus for the next year to drive baseline assessment in our 2021/22 report, which showed Categorising assets by alignment further improvement in alignment with the goals of the Fund was on a 2.5°C global warming trajectory. The ITR score is useful in allowing us to aggregate the Committed to align/aligning: Assets with ITR score the Paris Agreement. In summary: di昀昀erent asset classes to give an overall Fund assessment, between 1.5 and 2°C; companies with approved Our December 2022 update indicates the Fund’s ITR but it is more limited in understanding the progress of SBTi target or target set; countries with a Net Zero • For Liquids Markets where data availability score has reduced to 2.3°C (see chart), driven largely alignment. Therefore, we have spent a lot of time further commitment or NDCs ‘almost su昀케cient’ and coverage of ITR/SBTi is greater, action is by improvements in our Equities, Corporate Credit classifying the portfolio (by asset class) into alignment Not aligned: Assets with ITR score over 2°C and no centred around our new Climate Watchlist of and Real Estate books. categories, informed largely by the IIGCC’s Net Zero SBTi target companies requiring targeted engagement on Investment Framework. Insu昀케cient data: Assets that we are unable to model climate transition Not included: Assets or asset classes considered • For Private Markets, the alignment project out-of-scope for the project has emphasised the need for portfolio company disclosure so we can start validating Note: The PPF ESG team’s in-house assessments based on Ortec proxies and replace them with real data. See 2020 and 2021 results, MSCI ITR 2022 analysis, SBTi approved more about how we are progressing this on targets and countries’ targets. Alignment categories are leveraged page 18. from the IIGCC Net Zero Investment Framework.

14 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED How we assess the risks and opportunities Progress on Climate scenario analysis Our climate transition scenarios Our external data provider, MSCI, has updated its overall Climate Value At Risk When stress-testing the Climate Value at Risk (Climate VaR) of our (VaR) models by incorporating a number of improvements. This does mean portfolios, we take into account a number of climate transition scenarios that we cannot directly compare this year’s results with last year’s due to the that align with those developed by the Network for Greening the Financial signi昀椀cant number of enhancements: System (NGFS): • Improvements in physical risk analysis: Physical risk analysis has been Our scenario category Equivalent NGFS scenario expanded. Speci昀椀cally, MSCI now includes two new datasets, Regional Company Exposure to Physical Hazards and Regional Physical Hazard 1.5 degrees orderly Net Zero 2050 (1.5°C) Metrics, which aligns with TCFD recommendations. 1.5 degrees disorderly Divergent Net Zero (1.5°C) • Reduction in the Transition Climate VaR time horizon from 2100 to 2050: This is a welcome change given the global focus on achieving Net Zero 2 degrees orderly Below 2°C 2 degrees disorderly Delayed transition by 2050. • Re昀椀nement of assumptions for the Technology Opportunity model: Hot house world Current policies Calculations of low-carbon revenues for each company have been enhanced and the projected electricity generation fuel mix now re昀氀ects each climate transition scenario. (Previously, the projected electricity generation fuel mix NGFS scenarios framework was based on IEA data that was aligned with a speci昀椀c temperature but was not scenario speci昀椀c, i.e. ignored whether the transition would be orderly gh or disorderly.) i H Disorderly Too little, too late The chart below shows the impact of the worst transition risk scenario and the worst physical risk impact on each of our Liquids portfolios. For all three portfolios, it is the same scenarios that are the most disruptive i.e., 1.5 degrees disorderly/Divergent Net Zero combined with aggressive physical risk impacts. The Credit and UK Credit portfolios are found to demonstrate more resilience Divergent to both physical and transition risks than the Equities portfolio, based on the Net Zero VaR outputs. (1.5ºC) See our detailed Climate VaR results in the Metrics & Targets section. Delayed Climate VaR quick overview relative to our portfolios Enhancements to external manager ESG reporting transition s There have been no signi昀椀cant changes to our quarterly ESG reporting template k is 30% for our Liquids managers which is now very comprehensive and has led to an r n improvement in the quality of reporting, especially on climate risks. We continue o iti 25% $2.98bn to look to improve the depth and comparability of ESG reporting among our ns external managers, with progress on the reporting of alternative assets: a r T R Net Zero a • Real Estate: Our annual reporting template seeks to encourage V 20% 2050 (1.5ºC) l a $1.77bn standardisation and requires managers to include energy ratings and c i s y performance certi昀椀cates. h P 15% e • Farmland and Timberland: We started asking for additional data in 2020 to Below 2ºC v i s $4.62bn enable more accurate and standardised alignment and carbon sequestration NDCs es10% gr assessments, although this is still a work in progress while managers use Current Ag di昀昀erent sequestration methodologies. policies 5% • Private Markets: The eFront ESG Outreach Project has expanded coverage this year to include all Private Markets. One caveat is that the current 0% questionnaire does not di昀昀erentiate between companies and real assets, w Orderly Hot house world 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% which we raised with the Outreach team. Lo Highest Transition VaR Low Physical risks High Equities Credit UK Credit

15 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED Summary of our processes and tools for assessing climate risks across asset classes The table, right, summarises the METRIC/PORTFOLIO COVERAGE ASSET CLASSES COVERED WHAT IS MEASURED progress made over the year to measure our climate-related risks in each asset class, through a range Absolute carbon emissions apportioned (using EVIC) to PPF’s holdings (tonnes CO e) Carbon emissions 2 of tools and metrics. 55% of total PPF portfolio This year we have indicated the value covered Equities, Credit, UK Credit, Relative carbon intensity apportioned (using EVIC) to PPF’s holdings, normalised by percentage of the PPF portfolio that Sovereign Debt amount invested (tonnes CO2e/USDm) can currently be assessed per metric. Weighted average carbon intensity of PPF’s holdings, normalised by revenues (corporates) or PPP-GDP (sovereign), (tonnes CO2e/USDm) Real Assets Work in progress Climate Value-at-Risk Transition risks – policy risk costs, technology opportunities (% of Enterprise Value) (Climate VaR) Equities, Credit, UK Credit Physical risks (% of Enterprise Value) 55% of total PPF portfolio value covered Sovereign Debt Climate VaR metrics – work in progress Portfolio alignment • % of portfolio companies committed to the Science Based Targets initiative (SBTi) 95% of total PPF portfolio All asset classes or other science-based targets value covered • Implied Temperature Rise, expressed in °C (by 2100) Sustainability exposure* Equities Green revenues/exposure to companies classi昀椀ed as low-carbon solutions 63% of total PPF portfolio value covered Credit (sovereign & corporate) Green Bonds, Social Bonds, Sustainability Bonds and Sustainability Linked Bonds * See our classi昀椀cation of ‘sustainable’ investments on page 33. Real Estate High Quality Standard Certi昀椀cation/High Energy Rating Private Assets (work in progress) Renewable Energy, Forestry, assets classi昀椀ed as green opportunities by internal/ external manager

16 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED How we manage the risks identi昀椀ed Considering the positioning During the year, we continued to CASE STUDY of our portfolios re昀氀ect the Institutional Investors Group The move to our climate-aware on Climate Change (IIGCC)’s Net Creating our Climate Watchlist equity benchmark, as reported in our Zero Stewardship Toolkit in our own Climate Change Report 2022, has been stewardship processes around climate This year, in line with the IIGCC’s Net Zero Stewardship Toolkit’s guidelines, instrumental in enabling us to improve risks. The toolkit aims to raise the bar we identi昀椀ed our Climate Watchlist: 87 companies in material sectors that our Equity portfolio’s emission pro昀椀le. for investor climate stewardship by collectively are responsible for over 70 per cent of the 昀椀nanced Scope 1 and 2 providing a systematic framework to emissions associated with our public markets investments. Our Equity passive mandates closely help investors prioritise high-impact track this benchmark. Additionally, we engagement while systematically Of these 87 companies – which are predominantly based in the US and Asia- use the information reported to us by ensuring they have measures in place Paci昀椀c – we are already engaging with 45 through the Climate Action 100+ our managers in our quarterly ESG to hold laggard companies to account. (CA100+) investor initiative. A further 22 are targeted for engagement by EOS, templates to review any material risks our Stewardship Services Provider. We are now identifying the best options for highlighted by them and compare these Establishing our voting guidelines engaging with the remainder, whether directly or through collaborations. against our own internal monitoring. on climate change This has allowed us to have much As mentioned in the previous section, more constructive discussions in our we updated our voting guidelines Our Net Zero engagement process manager review meetings, so we can during the year to integrate various understand their investment theses climate measures into our wider voting Undertake portfolio Achieve asset and potentially challenge them on strategy. This includes specifying alignment analysis, set Set Net Zero alignment Develop an owner and Establish a baseline their assumptions where necessary. some of the key escalation situations alignment goals and criteria, alignment engagement strategy manager alignment, engagement and The stewardship sections of our where we will consider voting against develop a stewardship levels and time bound for priority companies engagement and voting policy, and manager reporting template also management on issues including prioritisation framework engagement objectives transparency escalation approach provide us with more detail on how climate change. our managers are engaging with issuers We are reviewing all companies on or policymakers, and highlight progress our Climate Watchlist held by our Breakdown of Climate Watchlist engagement In addition to engagement, we have recently formalised an escalation made, or speci昀椀c escalations taken. external managers to ensure voting strategy for the Climate Watchlist that can be deployed when engagements Stewardship and engagement continuity where appropriate. The are either failing or progressing too slowly. Financed emissions analysis of Climate Action 100+ initiative (see 70%+ 昀椀nanced the PPF portfolio will be undertaken at least annually to ensure our Climate We engage extensively with all our page 17) highlights resolutions of emissions* – Watchlist always holds the most relevant names. external managers to encourage interest to members, alerting us to key 87 companies ongoing improvement in their proposals to take into consideration Our annual Responsible Investment report provides more detail on the approaches to managing climate during the voting season. We leverage stewardship activities and progress of EOS, our fund managers and any risks and ensure they continue to this list of resolutions as part of our EOS engagement direct or collaborative engagements we have carried out. This includes meet our standards in this area. Our oversight process. universe – activities related to climate issues. stewardship services provider EOS 22 companies prioritises climate risk and opportunity management in its engagement with issuers, which feeds into voting The creation of our Climate Watchlist is recommendations at company AGMs. a signi昀椀cant achievement, enabling us to hone CA100+ list: in on the companies that will have a real impact 45 companies on emissions reductions of the portfolio. Daniel Jarman * Using Scope 1+2 emissions. Stewardship Manager

17 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED Industry collaboration We continue to participate in valuable CASE STUDY CASE STUDY climate-focused memberships and networks, such as the IIGCC and the Climate Action 100+ Supporting CDP ongoing Climate Action 100+ initiative. This year, the IIGCC launched a new The PPF is a signatory to Climate Action 100+, the largest- We continue to work closely with CDP, the global Net Zero Engagement Initiative (NZEI) ever investor engagement initiative on climate change, environmental disclosure organisation, on two to scale and accelerate climate-related involving around 700 investors who collectively hold half of corporate engagement. The new the world’s assets under management. Climate Action 100+ campaigns to encourage comprehensive and initiative aims to help investors align puts pressure on the world’s largest greenhouse gas emitters, more of their investment portfolio with which together account for approximately 80 per cent of global robust corporate disclosure on climate and the goals of the Paris Agreement by industrial emissions. 58 per cent of our 昀椀nanced emissions are environmental issues. extended focus beyond the companies attributed to Climate Action 100+ companies. on the Climate Action 100+ list. We A 2022 progress update found that, of 166 companies covered The 2022 CDP Non-Disclosure are leveraging the NZEI initiative to by the initiative: Campaign was fruitful overall, with further align collective engagement companies engaged in the campaign with our Climate Watchlist, which has • 92 per cent have some level of board oversight of material 2.3 times more likely to disclose than emerged from our own Paris Portfolio climate-related issues those that weren’t. Alignment Project. We are leading direct Non-Disclosure Campaign: engagement with one of the NZEI • 75 per cent of targeted companies have made Net Zero Science-Based Targets companies as part of the initiative. commitments (52 per cent in 2021) Again this year, we supported (SBT) Campaign: CDP’s annual campaign to engage The CDP Science-Based Targets The following three case studies • 91 per cent now report in line with TCFD recommendations with major companies that have (SBT) Campaign was launched in highlight the progress made over the (72 per cent in 2021). failed to respond to its climate October 2022, attracting support year for the key industry collaborations change, forestry and/or water from 318 昀椀nancial institutions and we’re involved with. Examples of recent progress seen in companies include: security questionnaires. multinational 昀椀rms, including the Eneos Holdings: The Japanese petroleum and metals company We elected to lead direct outreach PPF, representing $37 trillion in announced in May 2022 its plan to reduce Scope 1 and 2 emissions e昀昀orts with eight companies in assets and spending. The campaign 75 per cent of by 46 per cent by 2030 compared to 2013 and expand its Net Zero our portfolios. Three companies called on over 1,060 of the world’s ambition to cover Scope 3 emissions (Net Zero by 2050). submitted responses as a result highest-impact businesses to set targeted companies of this, directly bene昀椀ting the emissions goals in line with the Origin Energy: The Australian energy company made progress coverage of reported emissions Paris Agreement. in the CA100+ have on climate disclosures and commitments during the year, within our portfolios. For the names including the closure of its coal-昀椀red power stations seven years Last year’s 2022–2023 campaign made Net Zero earlier than previously announced and the inclusion of Scope 3 that declined to respond in 2022, resulted in 77 targeted companies, emissions in its long-term plans. we have re-elected to lead direct as of end-May 2023, joining commitments engagement again with these the ranks of 5,100+ companies Enel: The second-largest power company in the world, based companies in the 2023 campaign. committed to using science-based (52 per cent in 2021). in Italy, became the 昀椀rst company globally to ful昀椀l all its We have also used the lack of targets to align their business with disclosure obligations on the Climate Action 100+ Net Zero disclosure to inform our voting the Paris Agreement. They represent Company Benchmark. 0.2 gigatonnes in CO e emissions decisions at these speci昀椀c 2 Although the success of this initiative has been encouraging, companies, for example if a and $2.9 billion in market cap, there is a long way until companies achieve high-level shareholder resolution has been which is respectively 3 per cent performance across all indicators assessed by Climate Action 昀椀led to request this, or voting and 12 per cent of the 2022 CDP 100+. Lots more work needs to be done as the initiative moves against the audit committee in corporate database. into its second phase this year. more extreme circumstances. Read more about the PPF’s own exposure to companies using science-based targets on page 30.

18 Pension Protection Fund Climate Change Report 2022/23 STRATEGY AND RISK MANAGEMENT CONTINUED CASE STUDY eFront ESG Outreach project We have been closely involved in an ESG outreach project led by one of our data solution providers eFront (part of BlackRock) to address the lack of ESG and climate-related data and reporting from private companies. We joined the eFront ESG Outreach pilot project as In terms of emissions data reported for the PPF a limited partner (LP) in late-2021, working with a funds in the pilot: selection of private equity and credit general partners (GPs) managing funds with vintage years from 2015 to • 37 per cent of our portfolio companies reported collect relevant ESG and climate metrics on underlying GHG emissions data, of which just over half was portfolio companies. actual rather than estimated data We anticipate this initiative will go a long way to • The frequency of Scope 1 and 2 emissions disclosure improving the process for private market data collection, was much higher than Scope 3; only 25 per cent especially among smaller managers that haven’t yet built of companies reported on Scope 3 whether actual out their own reporting functionality. The ultimate aim or estimated (similar to public markets) is to open the product up to over 2,500 private market • eFront was also able to o昀昀er LPs the option to 昀椀ll managers, reaching over 70,000 private companies. some data gaps with higher-level sector estimates; With our encouragement, 60 per cent of our own as a result, emissions data (whether actual or managers that were contacted in the pilot phase reported estimated) was available for just over 90 per portfolio company data – four times higher than the cent of our portfolio companies in the funds that overall response rate. responded to the pilot. Next steps The 2023 update has been signi昀椀cantly expanded across the eFront platform and increased eightfold for PPF’s GPs. As part of the broader roll-out this year, it has been recognised that more education is needed among GPs to raise awareness of the regulation that LPs face in di昀昀erent jurisdictions and the timeframes for reporting.

19 Pension Protection Fund Climate Change Report 2022/23 Metrics and targets The increased reporting For another year, we can report advancement Year-on-year comparison of carbon emissions disclosure rates (by market value) on carbon emissions by in the breadth of climate-related disclosure 100% 1% 1% 2% 4% 昀椀xed income issuers is a 24% 18% 23% 27% 11% 7% 10% 20% 19% across asset classes, including new metrics 29% 44% 19% welcome result, giving us 80% 81% 15% 18% more comprehensive to report on our portfolio’s alignment with 75% 75% 72% 60% 69% 65% 63% data points. Paris Agreement temperature targets. 60% 40% 49% Corporates’ disclosure rates and 20% data quality 0 Good quality disclosure ensures that Additionally, a few of the new Equity 2022 2021 2020 2022 2021 2020 2022 2021 2020 our analysis of climate-related risks positions added to the portfolio Equities Credit UK Credit is as valuable and decision-useful during the year have a ‘lower’ quality Reported Estimated Not Covered as possible. We measure whether of emissions reporting than the carbon emissions are reported by positions being sold. Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution. portfolio companies themselves, or if they need to be estimated by our More positively, less than 1 per cent of Year-on-year comparison of contributions to total carbon emissions by source of data ESG data provider, or are classi昀椀ed as our Equity holdings by market value not covered at all. We also look at the have no coverage at all – an all-time low. 100% 5% split between reported and estimated 17% 17% 25% 25% 38% 9% 8% 95% 6% The reported carbon emissions by 91% 92% 94% carbon emissions data but on a market value for global Credit and 80% 83% 83% weighted by emissions basis (rather UK Credit continue to show year- 75% 75% than just weighted by market value). on-year improvements, hitting 69 60% per cent and 72 per cent respectively. 62% This year’s assessment of reported emissions for our Equity holdings For the Credit book, this is due to 40% fell by around 5 per cent back to higher-quality emissions reporting for 2020 levels. This is primarily because existing positions, and new positions 20% of companies that had not reported in the portfolios having better quality their most recent emissions or disclosure than sold positions. provided insu昀케ciently complete 0 emissions data, so our external We are pleased to see a year-on-year 2022 2021 2020 2022 2021 2020 2022 2021 2020 provider had to apply estimates. halving in the percentage of UK Credit Equities Credit UK Credit assets by market value that are not Reported Estimated However, the overall percentage covered, from 20 per cent to 10 per of reported data based on the cent, helped by our data provider Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution. contribution from carbon emissions increasing its coverage of 昀椀xed income Some 昀椀gures may add up to more than 100% due to rounding. has remained stable since last year, issuers. However, we can also see a fall with 83 per cent of the companies in the percentage of reported data for most responsible for the portfolio’s UK Credit based on the contribution footprint providing disclosure. from carbon emissions, which is something we will be monitoring.

20 Pension Protection Fund Climate Change Report 2022/23 METRICS AND TARGETS CONTINUED Asset class coverage The diversity of asset classes that we are invested in can Next steps of companies in our new make it challenging to report our 昀椀nanced emissions for the whole of our portfolio. We continue to footprint Public We are doing our best to achieve maximum Climate Watchlist reported Equity and Corporate Credit for the third year and UK emissions coverage for the public books, and it is 84% Sovereign Debt for the second year. We have also added an explicit part of our engagement strategy for our in the 2022 CDP annual initial assessments for Emerging Market Sovereign Debt Climate Watchlist. The coverage achieved so far for the 昀椀rst time. is reasonable but of course there is still room for disclosure questionnaire Our more recently added assessments for UK Sovereign improvement. We also continue to explore ways to Debt and EM Sovereign Debt both achieve 100 per cent meaningfully cover the remaining instrument types coverage thanks to good country-level coverage by our within our Liquids portfolios. data provider, although this asset class faces a more signi昀椀cant lagged data problem. This does mean that the carbon footprints for these portfolios are another year behind that of our corporate-based portfolios. This is another reason why we have chosen not to aggregate our corporate and sovereign emissions data. Methods for covering the outstanding instrument types that we have to consider out-of-scope in public markets are still not widely available. In particular, we still cannot assess: Derivatives (e.g., CDS and futures), certain funds with no portfolio look-through, and true Cash positions. We also exclude short positions. However, we have been able to include lookthrough-based assessments for the Equity ETFs (within the Equity passive book) and Municipals (within the Credit book) this year. As mentioned previously, getting coverage of companies in the Private Markets space has long been a signi昀椀cant challenge. However, we are now starting to see some emissions data materialising through the eFront ESG Outreach project for a selection of our private markets funds. Other initiatives such as the ESG Data Convergence Initiative (EDCI) have also seen strong fund participation over the past year, and eFront fully captures the EDCI metrics to allow GPs and portfolio companies to report to both frameworks in a standardised way.

21 Pension Protection Fund Climate Change Report 2022/23 METRICS AND TARGETS CONTINUED Absolute carbon emissions Again this year, we measured the total Scope 1 See Appendix D for more detail on the formulas used for and Scope 2 carbon emissions associated with our our calculations. UK and EM Sovereign Debt portfolios Reasons for fall in Equities’ absolute emissions Like last year, we have delved deeper into the liquid investments in global equity (‘Equities’), global are excluded from the absolute carbon emissions table; It’s important to note that absolute emissions for drivers causing the 57 per cent reduction in total investment grade and emerging market credit (‘Credit’) we report relative intensities only for sovereigns (in the Equities have fallen largely because of reductions in absolute 昀椀nanced emissions in the Equities portfolio. and the publicly-traded sterling credit sleeve within next section) as we feel comparing country-level absolute the portfolio’s value, due principally to asset allocation Changes in the portfolio holdings accounted for a 61 our internally-managed UK hybrid assets (‘UK Credit’). emissions alongside corporate emissions is counterintuitive. changes during the year (see page 10 for SAA changes). per cent reduction, yet we actually saw a 5 per cent Collectively, this accounts for $9.4 billion of our overall The next section looks at the year-on-year changes in increase in company emissions year-on-year. This is assets under management – around a quarter of our overall Our total absolute 昀椀nanced emissions in this portion of emissions on a relative basis, which allows for more most likely driven by the reopening of many industries AUM. This year, we have also started reporting Scope 3 our portfolio have reduced by around 40 per cent over the comparable year-on-year analysis. after two years of production declines due to Covid- emissions, although we are not aggregating them with year, and by 62 per cent since Dec 2020. More speci昀椀cally, related lockdowns. This is disappointing to see, although our Scope 1+2 emissions. Page 24 has more detail on this. Equities reduced by 57 per cent, Credit by 27 per cent and not surprising, and it indicates a strong need to continue UK Credit by 22 per cent since 2021. engaging with companies to encourage more transition- Our total 昀椀nanced emissions in tonnes for 2022 for listed equity and credit holdings planning and for science-based emissions targets to be set. This is why the CDP SBT campaign is so critical. Scope 1+2 Scope 3 emissions Causes of change in PPF Equities 昀椀nanced carbon emissions between 2021 and 2022 (tCO e) (tonnes CO e) 2 emissions 2 PPF AUM Scope 1+2 (tonnes Scope 3 – Scope 3 – assessed carbon data COe) upstream downstream ($m) coverage* 100 -61% 2 100% 5% Equities 170,370 455,226 1,149,779 2,977 99% Credit 233,705 391,542 1,271,796 4,617 82% ) 80 e2 UK Credit 62,509 122,909 191,880 1,769 77% O C Total 昀椀nanced emissions 466,584 969,677 2,613,455 9,363 86% es 60 n n o t ( s * This metric shows the percentage coverage of holdings that have either reported or estimated emissions data and an available 昀椀gure for Enterprise Value n 40 43% o Including Cash (EVIC). EVIC is essential for apportioning absolute 昀椀nanced emissions, but is not always available for 昀椀xed income holdings. Certain i s s information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution. i m e 20 Year-on-year change in our Scope 1+2 total 昀椀nanced emissions for listed equity and credit Percentage change in financed carbon0 tCO e $m PPF Equities 2021 Change in company emissions Change in portfolio holdings PPF Equities 2022 2 or AUM 1,600,000 16,000 14,754 14,522 Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution. 1,400,000 14,000 94,378 12,000 1,200,000 1,000,000 329,106 9,363 10,000 Our total 昀椀nanced emissions for listed equity and credit reduced 800,000 80,412 8,000 by -41 per cent from last year. 796,972 321,205 6,000 600,000 62,509 400,000 395,353 233,705 4,000 200,000 2,000 170,370 0 0 2020 2021 2022 Equities tCO e Credit tCO e UK Credit tCO e AUM (RHS) 2 2 2 Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution.

22 Pension Protection Fund Climate Change Report 2022/23 METRICS AND TARGETS CONTINUED Relative carbon intensity We continue to use three key metrics to assess the relative PPF Equities carbon metrics emissions-based intensity of our portfolios, giving us a fuller picture and allowing us to measure di昀昀erent asset classes 350 and di昀昀erent sizes of portfolio on a like-for-like basis. See c i Appendix D for an explanation of each of these metrics. r 300 et 299 m n 250 Including UK and EM Sovereign Debt emissions in our o 257 243 relative carbon intensities analysis means we can now illi 226 m 200 $ analyse $21 billion or 55 per cent of the total PPF portfolio r pe150 in this way. 154 e2 151 O 122 125 C 100 Equities portfolio: carbon intensity metrics 112 108 es 83 83 n 70 74 The December 2022 carbon footprint analysis for listed n 50 65 57 o Equities shows ongoing progress, with all three metrics T 30 34 seeing a year-on-year fall. The two intensity metrics 0 PPF financed Benchmark PPF financed Benchmark PPF weighted Benchmark dependent on company revenues show higher year- carbon emissions financed carbon carbon intensity financed carbon average carbon weighted average on-year reductions, which implies that the portfolio is (tCO e/$m emissions (tCO e/$m intensity (tCO e/$m intensity carbon intensity 2 2 2 invested) (tCO e/$m invested) revenues) revenues) more exposed to companies operating more e昀케ciently 2 this year (i.e. a lower ratio of emissions per unit of December 2020 December 2021 December 2022 revenue generated). Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution. See Appendix C for However, the Equities Book still has higher relative Equity benchmark. emission intensity than its benchmark. This is mainly Credit portfolio: carbon intensity metrics due to our Active Equities book, whose carbon intensity Financed carbon emissions per $m invested for our global Credit book remained broadly the same as levels are roughly twice the level of the climate-aware last year and 昀椀nanced carbon intensity has reduced. However, the weighted average carbon intensity equity index we introduced last year. As mentioned (WACI) has increased this year, although is still lower than for 2020. Deeper analysis shows the externally- earlier, we have internally evaluated our Equities book managed Credit book is mostly driving this, which we are looking to address through our Climate and the companies accounting for the majority of Watchlist – 昀椀fty companies contributing around a third of our external Credit emissions are on our material high impact 昀椀nanced emissions are now on Climate Watchlist. EOS, our external stewardship manager, and our external managers are engaging with our Climate Watchlist of companies requiring more these names on our behalf. We also ask our external Credit managers for speci昀椀c climate engagement intensive engagement. reporting to ensure maximum oversight of what is driving our 昀椀nanced emissions metrics. PPF Credit carbon metrics c 350 i r 300 318 et m 279 n 250 o 255 illi m 200 $ 204 203 r 192 179 193 194 181 pe150 162 e2 133 O C 100 es 85 n 50 70 n 53 51 57 o 50 T 0 Benchmark Benchmark PPF weighted Benchmark PPF financed PPF financed carbon emissions carbon intensity average carbon weighted average financed carbon financed carbon (tCO e/$m emissions (tCO e/$m intensity (tCO e/$m intensity carbon intensity 2 2 2 invested) (tCO e/$m invested) revenues) revenues) 2 December 2020 December 2021 December 2022 Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution. See Appendix C for Credit benchmark.

23 Pension Protection Fund Climate Change Report 2022/23 METRICS AND TARGETS CONTINUED UK Credit portfolio: carbon intensity metrics We are pleased to see a reduction in all the relative metrics of our internally-managed UK Credit Book this year, particularly the 30 per cent improvement in weighted average carbon intensity (WACI). We are pleased to see a Interestingly, our bought vs sold positions this year have roughly the same contribution to WACI (49 vs 48). Forty-two per cent of the UK Credit book is in new positions, and for existing positions 34 per cent reduction in all the relative saw a reduction in carbon intensity, 13 per cent saw an increase and 3 per cent were unchanged. metrics of our UK Credit PPF UK Credit carbon metrics Book this year, particularly c 350 the 30 per cent improvement i r 300 et in 昀椀nanced carbon emissions m n 250 o per $m invested. illi m 200 $ r 175 pe 150 170 e2 153 153 O C 100 118 108 Emerging Markets es This year we have made a 昀椀rst attempt to assess the n n 50 o 47 relative carbon intensity of our sovereign bonds in T 41 35 0 emerging markets, now that our data provider is able PPF financed carbon emissions PPF financed carbon intensity PPF weighted average carbon intensity to assess 100 per cent of our holdings for carbon (tCO e/$m invested) (tCO e/$m revenues) 2 2 emissions within our EM Sovereign Bonds allocation. December 2020 December 2021 December 2022 As the table below shows, the greenhouse gas Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution. intensity of our EM Sovereign portfolio is lower than the benchmark. This book is mostly allocated to Assessing our UK Gilts exposure Emerging Markets sovereign issuers but there is currently The carbon intensity of our UK Gilts portfolio has marginally increased year on year. But this is due a percentage of the book allocated to US treasuries for to a lower GDP (denominator) rather than higher emissions. In fact, absolute emissions have fallen risk-management purposes. Our EM Benchmark is 25 year on year (from 452 to 409 million tonnes CO e, or 10 per cent). per cent in JP Morgan GBI-EM, 25 per cent in JP Morgan 2 EMBI and 50 per cent in a hypothetical cash position. We follow the PCAF (Partnership for Carbon Accounting Financials) methodology for sovereign To calculate the benchmark’s footprint, we have excluded debt for our UK Gilts’ carbon footprints, which recommends reporting of production emissions. this hypothetical cash (as mentioned earlier, pure cash is This year we revised our methodology to exclude land-use, land-use change and Forestry out-of-scope) but we appreciate that this might overstate (LULUCF), as now recommended by PCAF to avoid distorting results. Hence we have also the emissions of the benchmark relative to the portfolio. restated last year’s results. However, for the UK, this revised approach results in only a minimal change to the intensity metric. PPF EM Sovereign holdings: carbon intensity estimate PPF UK Sovereign holdings: carbon intensity estimate EM Sovereign EM Sovereign Bond Bond Portfolio Benchmark n y 250 o c Carbon intensity i en 217 r 200 (tonnes CO e per $m) 512 784 millr 208 210 2 r u c Coverage 100% 100% pe t 150 n 149 e2 a 142 144 v Note: Based on Production-based emissions (Territorial Approach) from O e C l 100 e EDGAR and GDP data from World Bank – World Development Indicators es r n i n 50 n P Certain information ©2023 MSCI ESG Research LLC. Reproduced by o T GD 0 permission; no further distribution. UK Sovereign carbon intensity UK Sovereign carbon intensity (GDP expressed in GBP) (GDP expressed in USD) December 2020 December 2021 December 2022 Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution.

24 Pension Protection Fund Climate Change Report 2022/23 METRICS AND TARGETS CONTINUED Scope 3 emissions For the 昀椀rst time this year, we are reporting Scope 3 emissions, as led by PPF Scope 3 emissions – PCAF Quality Score breakdown the Climate Change (Governance and Reporting) statutory guidance for Occupational Pension Schemes from the Department for Work & Pensions 1% 4% 11% (DWP). We have opted to focus our analysis on relative-only metrics as we feel 100% 35% absolute carbon emissions might be misleading for two reasons: 昀椀rst, Scope 3 29% emissions are almost entirely estimated, plus there is considerable double- 80% 18% counting across the scopes once Scope 3 is incorporated. 67% 71% Our Scope 3 emissions are estimated, however the majority have a Quality Score 60% 64% of 2 from the PCAF – see chart right (a PCAF Score of 1 presents the lowest data uncertainty and a score of 5 the highest uncertainty). 40% Few companies are currently reporting their Scope 3 emissions and where they do, they rarely cover all Scope 3 emissions categories. MSCI provides estimated Scope 3 20% emissions as a default, which equates to a PCAF Score of 4. Where possible MSCI will use a more sophisticated model which will lead to a PCAF Score of 2. 0 Equities Credit UK Credit PPF Scope 3 emissions – 昀椀nanced carbon emissions (tCO e/$m invested) 2 PCAF Q Score 2 PCAF Q Score 4 Not Covered 600 Certain information ©2023 MSCI ESG Research LLC. Reproduced by permission; no further distribution . 500 Note: Under the Scope 3 Emissions footprint quality score set by Partnership for Carbon 400 386 Accounting Financials (PCAF) Score 1 = lowest data uncertainty and Score 5 = highest data 300 uncertainty. This quality scope is valid for data in ‘Carbon emissions – Scope 3 Intensity (t/USD 200 275 million EVIC) for footprint calculation.’ This is based on estimated Scope 3 emissions using MSCI’s 100 153 85 70 proprietary model. MSCI always defaults to a PCAF quality score of 4, although some sub-models 0 108 use more sophisticated estimation approaches. Equities Credit UK Credit Scope 3 emissions by sector Scope 3 – upstream Scope 3 – downstream Whilst results shown left aggregate Scope 3 emissions across all sectors, we recognise that a few sectors tend to be responsible for a large proportion of PPF Scope 3 emissions – 昀椀nanced carbon intensity (tCO e/$m revenues) Scope 3 emissions, particularly in relation to downstream ‘in-use’ emissions. 2 We have therefore further analysed downstream emissions at a sector level for 1,200 each of the three portfolios. 1,000 976 Key 昀椀ndings are: 800 758 600 • Equities: Energy contributes by far the most to Scope 3 downstream emissions 400 (41 per cent), followed by Industrials (25 per cent), with Materials and Consumer 200 300 300 213 332 Discretionary contributing roughly 12 per cent each 0 • Credit: Energy contributes the most to Scope 3 downstream emissions Equities Credit UK Credit Scope 3 – upstream Scope 3 – downstream (27 per cent) followed by Industrials (26 per cent) and Transportation (14 per cent) • UK Credit: Industrials contribute the most to Scope 3 downstream PPF Scope 3 emissions – weighted average carbon intensity emissions (42 per cent), followed by Utilities (27 per cent) and Transportation (14 per cent). 600 583 500 566 400 300 311 200 254 192 191 100 0 Equities Credit UK Credit Scope 3 – upstream Scope 3 – downstream Certain information ©2022 MSCI ESG Research LLC. Reproduced by permission; no further distribution.